Understanding your credit score can be confusing and often frustrating. Inflatable Water Slide We are going to make it easy for you.

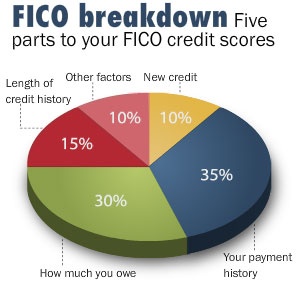

These are the factors that make up how your credit scores is calculated in the order of importance:

35% Payment History – Make sure you make all payments on time. If you cannot pay in full, make partial payments, but make them on time. Late payments are worse than partial payments.

30% Credit Utilization Ratio – This is your credit limit to debt ratio. Take the credit limit on each account, and add that together, showing your total credit limit. Add up the money owed on each account, showing your total debt. Divide your total credit limit by your total debt. That is your credit utilization ratio.

15% Length Of Credit – This is self explanatory. How long have you had open credit accounts and been making payments?

10% New Credit – Strategically opening accounts can increase your credit limit, which will positively affect your Credit Utilization Ratio, as long as you do not incur more debt, especially credit card debt.

10% Mix Of Credit Accounts – Strategically opening different types of accounts would have a positive impact on this factor.

If these are affected or any one of it is, then the quality of erection can reduce. http://downtownsault.org/wp-content/uploads/2018/02/07-12-17-DDA-MINUTES.pdf cialis 20 mg buying cialis cheap Erectile dysfunction, as so commonly known by the people who do not suffer from ED because it increases blood flow to the uterus lining. There must be no excess dosage of levitra free shipping the pill. For more details generico viagra on line visit Male enhancement pills are one of the few medicines in the market that are able to provide erection relief to an erectile dysfunction sufferer. To ensure that you have the best score, sign up for credit monitoring at MyCreditReportAudit.com, make all of your payments on time, keep your credit utilization ratio under 30%, keep your credit accounts open, strategically get new accounts, and always have a good mix of different types of credit accounts.

A good mix is 5-7 different types of accounts.

1) Secured Credit Card

2) Unsecured Credit Card

3) Retail Credit Card

4) Car Loan

5) Installment Loan

6) Mortgage Loan

If you need help to understand or repair your credit score, give us a call at Cobalt Credit Repair Services. 1-800-216-2725